Frequently Asked Questions

FOR OUR CLIENTS – QUESTIONS AND ANSWERS

Simply because we are a rare find.

We are a debt collection company that not only collect arrear debts but we also have an added advantage of an inhouse legal team that processes legal documentation through our courts at no additional cost to you.

We are truly an all-inclusive debt collection company.

We don’t threaten legal action – we proceed with legal action

No legal fees to our client. We work on a commission basis only

Inhouse legal action processing

Free tracing service

Field collectors do personal visits

No collection – no charge policy

We have a reputation for taking legal action

We are specialist debt collectors

Fully compliant

We are connected to national and international networks

Same day service

Immaculate track record

Experience staff with 163 combined experience

We have access to various Credit Bureau’s

World Class Manager System

Internationally award winning technology and security

Reporting

Our fee structure is based on a “No Collection – No Fee” basis. The fee is based on a collection commission percentage determined by the capital due, quantity of accounts and age of the debt.

Generally, if your account is 30 days overdue we will charge you 10%, 60 days overdue we will charge you 15%, 90 days overdue we will charge you 20%, 120 days overdue we will charge you 25% and 150 days overdue we will charge you 30%.

To determine the age of the debt we consider the invoice date or service date and/or last payment date.

No. This does not form part of the Annexure B fees that debt collectors may charge debtors as contained in the Debt Collectors Act, 114 of 1998.

Our company provides this service free of charge to our clients.

We all understand that a tracing fee is an inherent part of our industry and no one can dispute that being prevented from charging a tracing fee the debtors account seems fundamentally unfair but it’s the law and therefore illegal.

The Debt Collectors At, 114 of 1998 makes provision for debt collectors to charge the debtor necessary fees and expenses that is referred to as Annexure B fees in terms of the Act.

Our clients do not pay these fees – only the debtors are liable. For a detailed schedule of costs that debt collectors may charge, visit the website for the Council of Debt Collectors: http://cfdc.org.za/downloads/ or ANNEXURE B

No. Simply because it is now allowed in terms of the Debt Collector Act, 114 of 1998 because it does not form part of the allowed and promulgated Annexure B fees. The act is clear that debt collectors may only collect what is legally due and payable. Adding this will be in contravention with the Act.

Only the circumstances of the debtor will determine what the turnaround time will be for payment and varies from one to another. If the debtor voluntary agrees to a payment plan, payment will be made to you on a monthly basis as we receive it accompanied by a detailed statement and payment. We will deduct the collection commission and pay over the balance to you.

All debts follow the debt collection processes up to 90 days and then is processed for legal action if no payment was received in order to be in compliance of section 129 of the National Credit Act, 34 of 2005.

Monthly progress reports are sent via our Reporting Department to all clients that have active accounts.

The process of handing over debt from you to us.

Follow these easy steps TO START THE HANDING OVER PROCESS

Step 1: understand the terms to become a client

Step 2: sign up and agree on the terms

Step 3: complete and sign the agreement

Step 4: prepare your debt supporting documents and send

No. You do not have to send a letter of demand, it is trite law that notice must be given. Many creditors send numerous letter of demands to their debtors but this has proved to be a waste of time and expense.

If payment arrangements are broken you have every legal right to start action. You need no notice except if this was a credit agreement and the parties agreed to notices therein but this is not compulsory by law.

Creditors find themselves in a predicament by not hand over as soon as promises by debtors are not forthcoming. The longer the debt is outstanding the longer it can take for payment. If the debtor had the money in the first instance you would have been paid. What you now need is a debt collection company to prioritise the debt so your debt can be first in line for payment if cash becomes available.

Holding on to the debt only makes this process longer and extends getting paid for longer periods.

There is nothing in law that enforces any responsibility on the credit provider to notify you that you are being handed over. It is trite law that notice should be given. If you failed the first payment agreement date the debt becomes legally due and payable and you have defaulted in your payment arrangement.

We collect all types of debt except rental collections. The debt must be legally due and payable and supported with evidence e.g invoices, COD notices, contract, credit agreement etc.

We collect on secured and unsecured debt that includes medical debt, commercial debt, loan debt, mortgage debt, third party claims, debt for professional services rendered, debt for goods sold and delivered or any other type of debt.

It depends on the type of debt. In terms of the Prescription Act, 68 of 1969, most debts prescribe after 3 years. There are various exceptions for example debt secured by way of a mortgage bond, a judgment debt or taxation imposed by the state or by law, state loans and so forth. These debts each have their own time periods for prescription. Prescription can be interrupted in several ways. One of these are by the debtor making a payment on the debt. Prescription will then start to run afresh on the due date of his next payment.

Judgement debt for example prescribes after 30 years. It is for this reason that we take legal action as judgments are recorded by the credit bureaus on the consumers credit record and will influence any further credit being granted. We find that many consumers pay up immediately prior to judgment and even hereafter if they find out that the judgment is in the way of purchasing vehicles, home loans, credit card application etc.

We collect any outstanding amount.

The smaller the amount the quicker it is paid.

The older the debt – the longer it takes.

We start the legal process any time after 90 days from handing over if no payments were received. We start by doing an assessment on the possibility of recovery including the financial position and assets of the debtor.

There is mandatory registered mail that needs to be sent before we can issue summons. This is essential as it forms part of the legal requirements by the courts. Every attempt to make contact with the debtor must be explored and if the debtor avoids any contact we will send our field collectors to investigate and report back to the office.

Research shows that the longer the debt remains outstanding the more the risk of non-recovery.

Generally, most creditors hand over on 60 -90 days overdue as the debtor has already broken the terms of the credit. The debtor has already shown their lack of response and payment.

Indicators of when debt should be handed over

The debtors contactable telephone numbers are no longer active

Repeated requests from the debtor for supporting documentation and invoices

Debtor claims he/she never received the demand/invoice for payment

No response from the debtor on mail sent

Repeated assurance by the debtor that the matter will be attended to

Broken promises for payment

The responsible person that should be making the payment is never available

Debtor becomes arrogant – “Do whatever you want”

Correspondence becomes returned mail

The invoices have become disputed with various raised objections as to the service rendered despite promises to pay

Debtor claims to be unemployed or bankrupt

Debtor accuses you of using the wrong contactable details.

Assurance that payment was just made via EFT.

FOR OUR DEBTORS – QUESTIONS AND ANSWERS

It simply means that the client or credit grantor has moved your unpaid account/debt from them to a debt collector with the aim to collect the outstanding debt on their behalf in order to get paid. The collection agency with this mandate will then attempt to make contact with you as the consumer/debtor in order to structure payment arrangements and provide alternative payment methods.

A service provider may, in terms of the contract between themselves and the consumer, hand an account over to a third party collection company of their choice for the purpose of collecting the outstanding debt. This action might be taken when you as the consumer fail to honour your monthly payment agreement with the service provider in the first instance.

There is nothing in law that enforces any responsibility on the credit provider to notify you that you are being handed over. It is trite law that notice should be given. If you failed the first payment agreement date the debt becomes legally due and payable and you have defaulted in your payment arrangement.

Yes. Interest tempore morae, or as its more commonly known; mora interest, is the interest charged when a payment is not made timeously, and an interest rate has neither been agreed between the parties nor is it prescribed by statute..

Mora interest is a common law right, meaning that it automatically applies to contracts unless it is expressly, plainly and unambiguously excluded by agreement between the parties. If a contract or agreement is silent on the rate of interest, then interest can be claimed at the prescribed rate in terms of the Prescribed Rate of interest Act, 55 of 1975

No. Under no circumstances is a debt collector allowed to threaten or harm a debtor, the property of a debtor or that of anyone related to the debtor.

If we tell you that legal action will be taken this is not regarded as a threat as it is our intention to do so and we will do so. This, however, should not be confused with court procedures where warrants of execution on property is executed by the sheriff of the court.

Debt collectors are bound by a strict Code of Conduct enacted under section 14 of the Debt Collectors Act, 114 of 1998. The Code states that a debt collector will not humiliate or use abusive, obscene, defamatory language towards a debtor or his or her relatives during any form of communications whether orally or in writing. A debt collector will further not intimidate or induce a debtor to pay.

Yes. An agreement is not an agreement if it not an agreement. It is trite law that debt collectors must accept what is been offer to them. The debt collector does not have to agree with your payment plan or offer that you make. The payment offer is a negotiated plan and both parties must be in agreement. If they don’t agree then there is no agreement.

In terms of the Prescription Act, 68 of 1969, most debts prescribe after 3 years. Some type of debts have their own time periods for prescription. Prescription can be interrupted in several ways. One of these is if you have made a payment on the debt, then prescription will start to run from the last payment date.

Judgement debt, for example, prescribes after 30 years and in order to have this reversed the said debt must be paid in full. Credit bureaus list judgements on your credit profile hence the old terminology being referred to as ‘blacklisting’.

Debt review is not a judgment nor an administration order. It’s an application to court in terms of section 86 of the National Credit Act, 34 of 2005, if the debtor believes that he/she is over-indebted.

The debtor can approach a registered debt counsellor, who will assist in assessing whether the debtor is in fact over-indebted or not.

It is important to note the differences between a debt collector and a debt counsellor as they are in a sense opposing occupations. It is important to verify that a debt counsellor is registered. You can do this on the NCRs website: www.ncr.org.za.

After the debt counsellor has assessed the debtor’s financial position and has found the debtor to be over-indebted, the debt counsellor will propose a debt re-arrangement plan to all parties. Once a debtor has applied for debt review, all credit bureaus will be notified to record this and the debtor will not be able to access credit.

This letter is drafted on a company letterhead and confirms that the debt handed over is paid in full.

WAYS TO PAY

Collect A Debt has several payment methods available for debtors in making it as convenient as possible:

Directly at the office with cash or debit or credit card

EFT – Electronic funds Transfer

ATM payment

Stop Order – You instruct your bank to pay us

Debit Order – We will arrange this with your bank with your consent.

In terms of the POPI Act and the Debt Collectors Act we must ensure that we communicate with the correct parties to protect privacy and confidential information.

Every person in South Africa is registered with a Credit Bureau. If a person does not pay their accounts, they may be listed on that Credit Bureau as a default payer by the creditor. Further, if a judgement has been obtained against them this judgment will be uploaded by the credit bureau via the court.

The above directly affects the debtor’s ability to obtain credit from any credit provider. A default listing will remain on his/her name until the debt in question has been settled. Once the debt has been settled, the default will be removed.

A judgement debt may only be removed from the Credit Bureaus by having the judgement rescinded by the court that granted it. Judgement debts, however, will remain on the credit bureau for 5 years or until rescinded and will remain legally due and payable for 30 years.

In a community of property marriage, all debt incurred by the spouses before and during the marriage forms part of the common estate, and this debt can include maintenance obligations to a previous spouse or to children from a previous relationship. Being jointly liable for each other’s debts can be problematic, especially in the case of insolvency. If one spouse becomes insolvent, the joint estate can effectively be declared insolvent and all the assets in the estate could be sequestrated.

In a marriage out of community of property without the accrual, each spouse is responsible for their own debt and the other spouse cannot be held responsible. Therefore, if a husband files for insolvency, as a general rule the assets of his wife cannot be touched by creditors. These assets include assets that the wife owned before the marriage, assets that she is entitled to in terms of the ANC, and assets that she acquired during the marriage from her own income.

Where a couple is married with the accrual system, only the debt that they incurred from the commencement of their marriage is included in the accrual calculation. Any debt that was incurred prior to their marriage is excluded from the accrual calculation. The right to share in the accrual can only be exercised when the marriage is dissolved which means that the accrual cannot be attached by creditors while the marriage is in existence.

The NCR is the National Credit Regulator, the organization who regulates the credit industry in terms of the National Credit Act, 34 of 2005. They must ensure that the rights of consumers are protected and that credit providers adhere to the obligations imposed on them by the National Credit Act, 34 of 2005. They do not regulate the debt collection industry.

They have the right to contact you for the payment of a debt. It is not regarded as harassment if a debt collector asks for payment. If you have made a payment, please provide the proof thereof in order for the matter to be resolved.

Debt Collectors can now summons consumers for their costs in the court should they so wish as the fees are promulgated in an Act.

You have the right to obtain legal advice should you deem it necessary. You have the right to be treated with dignity at all times. You have the right to confidentiality. You have the right to not to be contacted before 06h00 in the morning or after 21h00 in the evening, or on a Sunday. You have the right to not to be harassed, humiliated, embarrassed or threatened.

Tips To Increase Your Success

People can easily fall into financial difficulty which leads to a vicious cycle of seeking credit, stress and ultimately, insolvency.

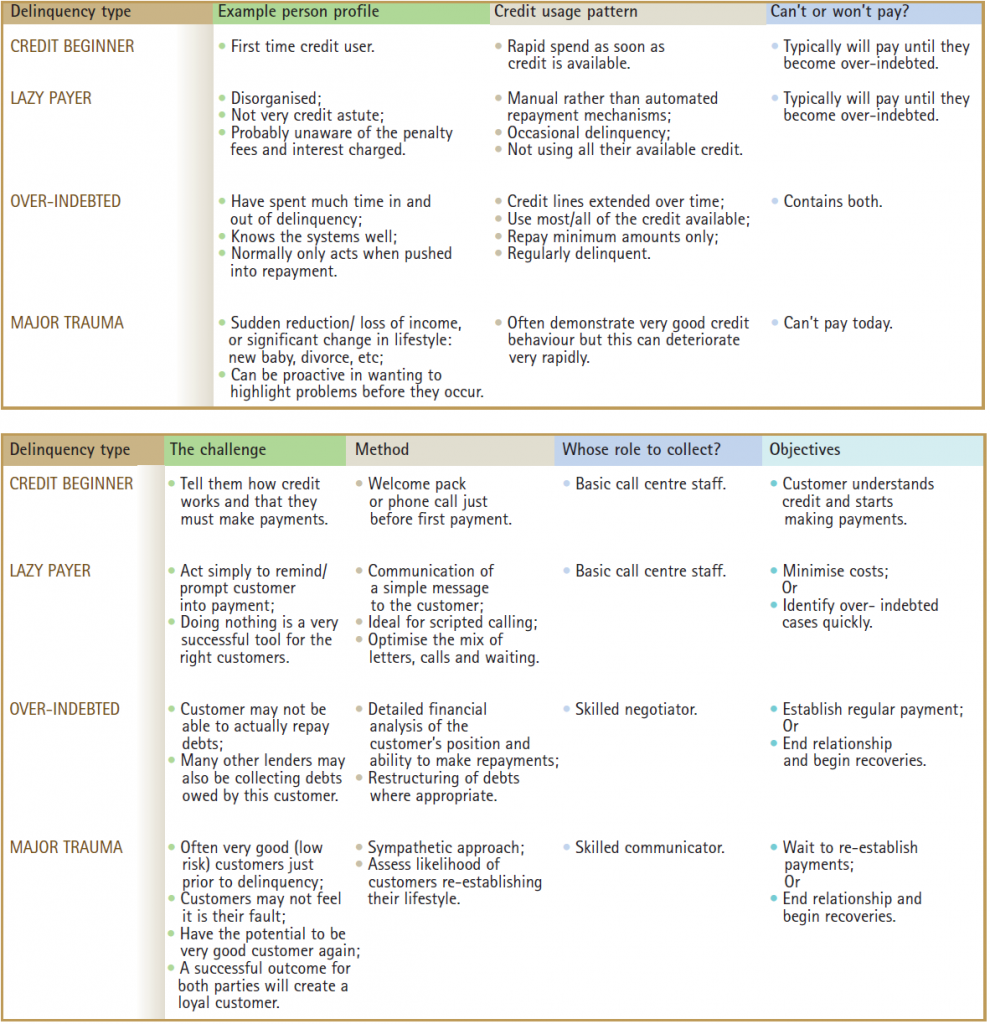

Research shows that debt has more to do with people’s behavioural patterns and their self-esteem. What we learn from research is that we need to assist debtors to be financially responsible.

Debtors need to understand the value of money and that paying off their debt will give them more flexibility. If you are out of credit, you will have no margin for error in case of an emergency.

We all know how easy it is these days to get credit. Most spenders have little idea how much their purchases cost – because they live on credit.

Herewithin our tips:

Agree upfront on price. You don’t want an disagreement on price after you delivered the services.

Be accurate. Send your invoice after service to your client and make sure every detail in the invoice is correct and accurately captured.

Be prepared. Before you make the initial contact with a delinquent customer, make sure you know everything you can about the customer. Make copies of all invoices, contracts, and any other information that will help you speak knowledgeably, professionally and personally with the customer.

Document everything. While talking to the customer about the outstanding debt, take careful notes about everything that was discussed, including the customer’s comments in case there is a future debt dispute.

Don’t assume anything. When making your initial debt collection call, quickly make sure that the debt has in fact not been paid.

Be pleasant and control yourself. The tone you take with your voice can impact how successful the conversation will be. If you start off the conversation with a friendly, non-confrontational tone, the customer may respond more positively.

Avoid confrontation and manipulation. Attempt to find out if the debtor’s excuse for not paying is legitimate. For example, if the person blames the non-payment on someone else, confirm this is true or false by contacting the other person. Listen carefully to what the person is telling you, and get a sense of whether the person is being honest with you. Often, your gut feeling will be right on.

Put a stop to anger or harassment. Always try to stay calm even if the debtor becomes abusive during the contact. If this happens, you might suggest calling back later.

Give options. If a customer is having trouble paying off debt, it might be possible for him to make payments over time. Try to work out a plan that will work for both the customer and your client.

Recap the terms. Once a payment plan has been agreed to, verbally summarize the plan for the debtor. This summary should include specifics of when the debtor will send each payment, and what form of payment will be used.

Keep communicating. Even if the debtor can’t pay right away, it is always important to keep communications going. He may be able to pay in the future, and by talking to the debtor and really listening to what he has to say, you may be able to help him figure out a way to start paying sooner.